Comprehensive Guide for Understanding Your Personal Injury Protection

As a “no-fault” state for auto insurance, Florida is in the minority. While Florida’s no-fault system requires drivers to carry personal injury protection (PIP) insurance, not everyone fully understands how it works.

The best time to get familiar with your PIP coverage is before you need to use it — not when you’re already in the midst of a medical emergency. Here’s a closer look at personal injury protection, required coverage, and how to cover healthcare expenses when you need to.

What Is PIP Insurance Coverage?

Personal injury protection (PIP) insurance coverage is meant to ensure that all drivers involved in a car accident can receive medical care immediately afterward. With PIP, drivers don’t have to go through the process of filing a personal injury lawsuit, negotiating a settlement, and possibly even going to court before determining whose insurance company will pay for their medical care.

For example, suppose that you’re driving to work one day when another car rear-ends you at a stoplight. In an at-fault state, you would likely need to immediately seek medical care, and then file a claim with the at-fault driver’s insurance company to cover it.

With PIP coverage, you would simply file a claim with your own insurance provider. Whether or not you were at fault for the accident, you would file a claim with your PIP insurance, and the other driver would file a claim with theirs. Because there’s no need to coordinate with a separate insurer, claims can be processed faster.

Mandatory PIP Coverage in Florida

Under Florida no-fault laws, every driver must have PIP insurance before they get behind the wheel. However, PIP isn’t the state’s only insurance requirement.

To keep your Florida registration active, you must do the following:

- Have at least $10,000 in PIP

- Have at least $10,000 in property damage liability (PDL)

- Maintain continuous insurance coverage even if you aren’t driving the car

- Buy your insurance from a broker licensed to sell policies in Florida

Notably, Florida’s no-fault insurance doesn’t apply to motorcycles. This means that if you’re injured as a motorcyclist, you must prove that the other driver caused your injuries — you can’t simply file a claim with your PIP insurance, and have your medical bills covered. This is at least partially due to the perceived risk of riding a motorcycle.

In Florida, you don’t even need insurance to register a motorcycle. However, if you’re found responsible for an accident with injuries, you must pay for the other driver’s medical care and property damage. The best way to ensure that you can do this is to take out a liability policy.

When Does PIP Coverage Apply?

If you get in an accident, your PIP coverage kicks in, regardless of whether you were at fault. However, your insurance doesn’t just cover you. It also extends to your family members, or passengers in your vehicle.

There’s one instance where your PIP coverage may pay someone else’s claim: when you hit a cyclist or pedestrian. These individuals aren’t required to carry PIP insurance. If they have it, they’re welcome to file a claim on their own. However, you must allow them to file a claim with your PIP insurance provider if you caused the accident.

Benefits of PIP Auto Coverage

PIP coverage comes with a host of benefits, including the following:

Medical Expenses Coverage

This is probably the clearest benefit. In many cases, PIP insurance can help you pay your medical bills quickly and easily.

Lost Wages Compensation

Some policies can reimburse you for a portion of your lost wages. However, not all do, so make sure to read the fine print.

Coverage for Essential Services and Funeral Expenses

If accident-related injuries are so serious that a loved one dies as a result, you may need this coverage to pay for funeral expenses, and other unexpected costs.

Rehabilitation Costs

Injuries take time to heal. Fortunately, your PIP insurance may cover ongoing rehabilitation for severe injuries. Improvement is always gradual, but dedicated rehab can help you get back to normal life faster.

Replacement Services

If you take care of the children in your household, cook, or otherwise meaningfully contribute to the home, PIP may pay for you to hire a temporary replacement.

Limitations and Exclusions of PIP Insurance

PIP insurance covers a lot, but not everything. While each policy is unique, most Florida PIP insurance coverage excludes the following:

- Expenses that aren’t related to injuries

- Injuries caused by committing crimes

- Work injuries

- Injuries to other drivers involved in the accident

It’s important to understand these exclusions, but you should also be mindful of your plan’s deductible and policy limit.

Your deductible is the amount you must pay toward your medical care before PIP kicks in, while your policy limit is the maximum amount your policy will pay out. If you still have medical bills after reaching your policy limit, you may need to rely on your health insurance to pay the rest.

PIP Coverage vs. Other Types of Insurance

Here’s a brief overview of PIP, and how it compares to other types of auto insurance:

| Type of insurance | What it does |

| Personal injury protection (PIP) | Pays for your medical treatment, no matter who’s at fault |

| Bodily injury liability | Pays for other people’s injuries |

| Property damage liability | Pays for damage to other people’s vehicles and property |

| Comprehensive | Protects your vehicle from vandalism, flooding, theft, and other unforeseen perils |

| Collision | Pays for repairs to your vehicle if you cause a crash |

While health insurance isn’t listed here, it’s worth considering if you exhaust your PIP coverage, and other car insurance benefits, but still have unresolved medical bills.

How to File a PIP Claim in Florida

If you get hurt in an accident, you should seek medical care immediately. While you don’t have to file your PIP claim from your hospital bed, it’s wise to do it as soon as possible. Here’s how the process typically works:

- Seek medical attention within 14 days

- Tell your healthcare provider you need to file a PIP claim

- Notify your insurer

- File your claim

- Submit supporting evidence

A lawyer can help you determine what evidence to include with your claim. Police reports, medical records, and photos will all be helpful.

What Are the Minimum PIP Coverage Limits in Florida?

Florida’s no-fault laws require everyone who drives a vehicle with at least four wheels to carry PIP insurance. The state specifies that each driver must have a PIP policy that covers 80% of their medical costs per accident, up to at least $10,000.

Keep in mind that this is the minimum required amount of PIP coverage. Given the high (and steadily rising) cost of medical care, you might consider purchasing more PIP coverage for peace of mind, and to ensure that you don’t encounter any unpleasant surprises if you must go to the hospital to seek care after an accident.

In addition to PIP, Florida insurance law also requires you to carry property damage liability (PDL) insurance to the amount of at least $10,000.

There’s a critical distinction to make here. While PIP coverage will pay for your medical expenses, PDL is effectively the opposite — it only pays for the property damage your car causes, not any damage your car suffers in an accident.

PIP Coverage in Other States

Only a handful of states require PIP coverage. Each state sets their own minimum threshold for insurance, and Florida has one of the lowest thresholds.

For the sake of comparison, New York drivers must have a minimum of $50,000 in PIP coverage. On the other end of the spectrum, Utah drivers must carry a minimum of $3,000.

It’s also worth noting that PIP coverage is mandatory in some states, such as Florida, Kentucky, and Michigan, and optional in others, such as Texas, Virginia, and Washington.

Get the Help You Need After an Auto Accident

Don’t make the mistake of thinking that having PIP coverage means you don’t need a lawyer. Even if you don’t intend to sue the other driver, having a skilled lawyer on your side while you file a claim with your own insurance company can be extremely helpful.

Insurance providers are required to pay out on qualifying claims, but like any insurance company, your PIP provider is likely looking out for their own interests above all else. The right lawyer can guide you through the claims process, and make sure you understand your options going forward.

Have you been hurt in a Florida car accident? Do you have questions about your PIP coverage? Reach out to Bernstein & Maryanoff, Injury Attorneys, to book your free consultation today.

Citations:

FAQs. (2025).

Florida Insurance Requirements. (2025).

Shopping for Auto Insurance. (2025).

Title 31A Insurance Code. (2025).

About the Attorney

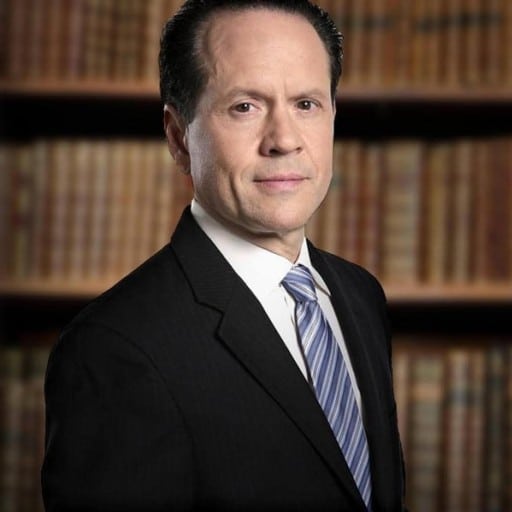

Jack G. Bernstein, ESQ.

Jack G. Bernstein, Esq., is a seasoned Miami personal injury lawyer who started his law practice in 1983. A detail‑oriented legal strategist with decades of experience in representing victims of auto, truck, motorcycle and slip‑and‑fall accidents, he is currently a member of the Florida Bar Association. He is admitted to practice before the State and Federal Courts of Florida, offering free, no‑obligation case reviews to injured clients and advocating for maximum compensation in car accidents, wrongful death, catastrophic injury cases and more.